SUPPORTING START-UPS

Read Episode 2: Business support structures looking for a new role and new models

IN SUMMARY

The unbridled rhythm of innovation, the risk of disruption, the volatility of clients and the dearth of talents. These are all factors pushing large groups to innovate not only quickly, but also efficiently. This innovation imperative requires, in particular, large companies and start-ups to come together.

However, large companies wanting to support start-ups is not enough to make the collaboration work. If innovation clearly constitutes a bridge linking the worlds of large groups and young businesses, its foundations can be weakened due to strategic objectives and ways of working that are structurally different.

Our mapping of business support structures in France makes it possible to understand the primary trends in the French innovation ecosystem, as well as the performance levers able to be used to support start-ups:

A. Large French groups are actively engaged in supporting start-ups. This is the case for 90% of CAC 40 companies, which have created their own structure, participated in multi-company schemes or joined existing structures.

B. Initially centred on the Parisian region, French innovation is developing rapidly outside the capital, with larger cities welcoming more and more support structures.

C. The trend is for structures specialised in the supporting entity’s sector(s) of activity: this is both a means of differentiation and a performance factor. It also enables the large group to integrate created value more easily into its own activity.

D. Five axes of reflection make it possible to define the most appropriate format of support for the large group’s strategic objectives. Four relate to the solutions provided: hosting, human, technical and financial resources; the fifth relates to the level of maturity of the start-up.

E. A third-party expert is essential to implementing the support strategy, but also its governance. It is a question of facilitating cooperation and maximising value creation between the parties involved, which may have extremely different cultures!

INTRODUCTION

Whether it is a matter of the heart or the head, the union between large groups and young start-ups today is vital to securing growth levers in a world under constant transformation.

But how can large groups get their bearings among the myriad possible support formats? From incubators to accelerators, via co-working spaces, company nurseries, fablabs and corporate venture capital, what criteria should a group choose to find the right support structure to meet its strategic objectives? Should it specialise in its own area of activity or stay generalist, ready to capture value wherever it can be found?

Accuracy has undertaken a mapping of French support structures to provide the necessary keys to fully understanding the ecosystems in place. This vision will make it possible to judge which third-party experts can provide assistance in finding a truly productive and profitable approach.

1. INNOVATION IS UNDERGOING A REVOLUTION!

HOW TO TAKE ADVANTAGE OF IT TO CREATE VALUE?

A. From absorption to support

In an ever more uncertain environment, innovation is no longer restricted to internal R&D investments, patent portfolio management and the integration of outsourced technologies. It is now closely linked to risk-taking, through investments in audacious projects: to stay in the race, companies have to bet on (more or less young) disruptive entrepreneurs.

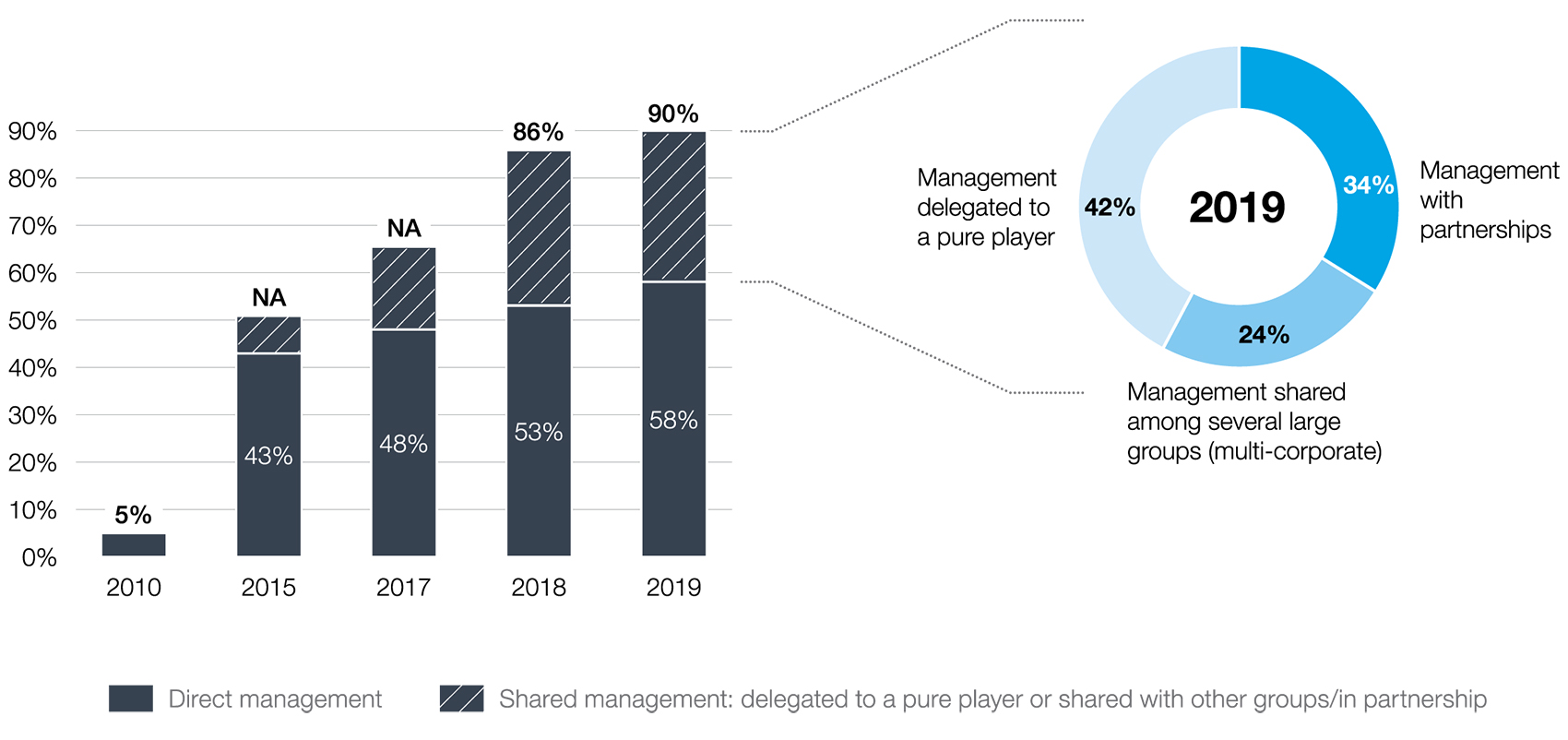

The majority of large companies initially adopted a strategy of absorption. This was sometimes aggressive and destabilising for the entrepreneurs, and often inefficient in terms of innovation. However, previous failures and the appearance of new open innovation tools have boosted new practices. Today, 90% of large groups favour start-up support structures, either by creating their own or by sharing or delegating the management of it.

Management of support structures in which CAC 40 companies invest

For example, the Vinci group created its own structure, “Léonard”, which among other things, stimulates intrapreneurship. It is all at once a start-up incubator, a co-working space and a meeting place for actors in municipal/regional transformation. As for Airbus, it signed a partnership with the incubator Centrale Audencia ENSA Nantes. In addition to the services provided by the incubator itself, those working there have access to a dedicated space (technical showroom and co-working space) able to host their intrapreneurial projects.

Other companies prefer to ask a third-party expert to set up their support system. For instance, AstraZeneca asked a pure player, Interfaces, to create and then manage its “Realize” programme, which aims to innovate in terms of a patient’s journey, data management and scientific innovation in the field of oncology.

B. A more and more balanced regional network

Paris and the French desert? Not so fast… It is not surprising that the capital is the nerve centre of French innovation: it boasts 26% of existing structures, including the top performing ones and those receiving the most media attention. However, the other regions of France are not to be outdone: major regional cities are also giving themselves the means to play a role in the race for innovation.

Indeed, the French ecosystem has a network of support structures that is becoming more and more complete. More than 700 municipalities have at least one support structure, and all regions are seeing their number of structures increase.

Breakdown of support structures in France

Our quantified analysis makes it possible to take an inventory of the situation and to predict the future dynamics of each region. Ile-de-France shows an innovation support ecosystem that is already relatively mature, whilst the other regions, even those already well developed such as around Bordeaux and Toulouse, continue to show strong growth prospects.

In short, France’s innovation ecosystem is rather logically based on the economic dynamism of the different regions and seems to form a Sun Belt à la française, which starts in Rennes and descends all the way down to the Nice region, passing by Bordeaux, Toulouse and Montpellier.

C. Innovation ecosystems more and more specialised by sector

In this regionalisation of innovation, certain areas have chosen to rely on their economic history to create specialised channels by sector. But is it better to go generalist or specialist? The majority of large groups have had to make this decision, with each adopting the strategy that seems most relevant to its strategic and economic imperatives.

However, the fact is that specialisation is gaining ground. Themed platforms now make up a significant proportion of the support structures in France. This may be because, on the one hand, the added value of the support may be significantly larger, and on the other, companies generally seek benefits in their areas of activity. Moreover, specialisation is a differentiation factor in the face of increasing competition following the rise in the number of support structures in recent years.

The development of the banking sector illustrates this transformation perfectly. Since 2014, Crédit Agricole’s “Village by CA” has spread throughout France, in line with the presence of its regional head offices, and regardless of the sector of application. Its aim is to assist entrepreneurs by providing coaching, a potential network of business partners and mentoring by bank employees, in the hope that they then become suppliers or clients of the bank. All other large banks have followed suit, creating their support structures, but sometimes limiting them to their core business lines. For example, “Plateforme 58” by La Banque Postale, is active in banking and insurance, as well as in financial technologies, health, education and services. As for BNP Paribas with its acceleration programme “Bivwak!” (in addition to “WAI”), HSBC with “Lab innovation” and Société Générale with “Swave”, they concentrate on innovations that are applicable to the bank’s business lines, supporting fintechs and insurtechs.

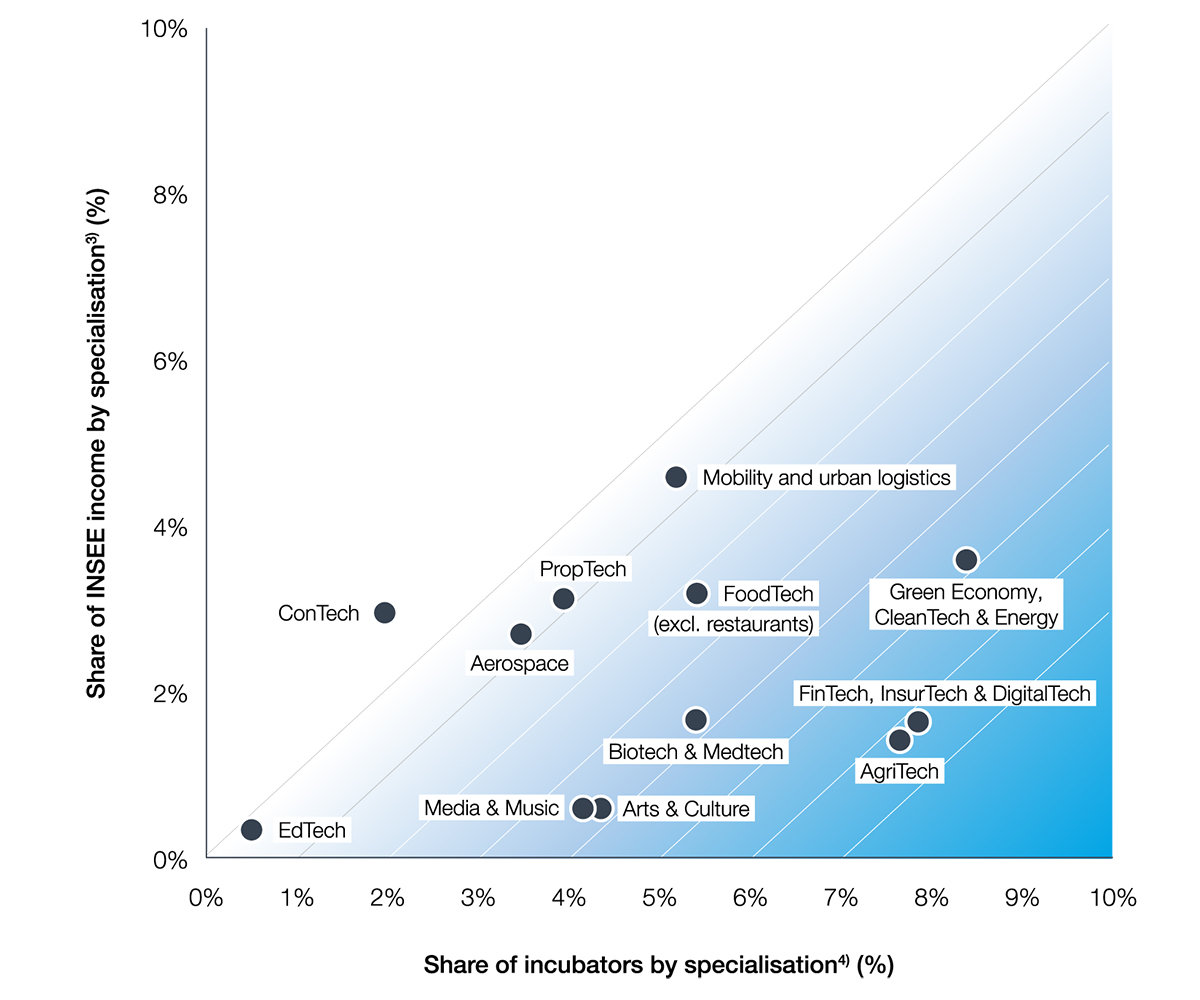

In this specialisation trend, certain sectors seem more attractive than others. The graph below clearly shows the areas that are over-represented in the innovation ecosystem when looking at their market size. In all probability, the greentech, fintech, biotech, and agritech sectors, but also media and communication, will drive innovation for the next few years. Hence why it is important for companies to position themselves now to secure the creation of value tomorrow!

Investment by specialisation

2. HOW TO CHOOSE THE RIGHT FORMAT FOR START-UP SUPPORT AND MAXIMISE RETURN ON INVESTMENT?

A. What type of structure for what strategic objectives?

Even if 90% of CAC 40 companies have chosen to invest in at least one start-up support structure, the format used is not always appropriate to achieve their strategic objectives.

There are multiple types of support structures. The services offered vary, ranging from simple hosting services to the provision of machine tools for prototypes, access to mentoring or bespoke acceleration programmes, the organisation of networking events and also assistance with financing. So how should a large group choose the most appropriate format for its strategic objectives?

Of course, it should start by clarifying these objectives, which underpin its investment logic. Is its ambition to obtain a quick return on investment? To participate in the development of a region to make it more dynamic? To monitor technology closely in order to integrate any developments by the start-up as quickly as possible? To face human resources challenges through intrapreneurship, the recruitment of new talents, the employer brand or the sharing of new ways of working?

Defining these objectives make it possible in turn to define the type of start-up to target (in particular, in terms of maturity) as well as its associated needs (hosting, technical means, human resources, and financial means). The relative weighting of these five elements therefore determines the most relevant support structure, in light of both the strategic priorities of the large group and the actual needs of the start-up.

Indeed, the mapping below presents the different support ecosystems that exist in France, based on the relative weight of each of these five criteria.

Mapping of main support structures

By way of example, incubators are essentially aimed at communication objectives, HR issues and technology capture, their offer mostly includes hosting, coaching or mentoring, and is aimed more at start-ups. As for fablabs, the objective is less geared towards communication and more towards the development of talents and regions. For that reason, they tend to deal with more mature projects (often in their prototyping stage), for which a large group may supply significant technical means.

B. The thorny question of governance: a trusted third party to make alliances last

Once the structure has been identified and fully considered, the difference – as usual – resides in execution.

First, to attract the most promising start-ups, groups must ensure that they bring a differentiating factor to the table. It is for this reason that Univail-Rodamco-Westfield offers the opportunity to test innovations and business models in its shopping centres, whilst the highly active communication surrounding EDF Pulse provides a strong level of exposure.

Second, supporting start-ups is an investment project just like any other, and in this respect, it requires the rigorous monitoring of KPIs defined in advance. This performance steering, whether it be through strategic partnerships, equity investments or support programmes, raises the tricky question of how much independence is necessary to innovate. How can a large group implement a governance structure making it possible to provide support to the start-up but without suffocating it? Adapting internal processes so as not to stifle the start-up’s development with too much rigidity, involving top management to strengthen the legitimacy of the programme internally, communicating regularly but not intrusively… There are many different success factors, the implementation of which may require the presence of a trusted third party.

This third party can contribute to building a bespoke support programme and supervising it once in place, particularly in the case of multi-company structures such as “Plant 4.0”, which groups together Total, Vinci Energies, Solvay, Eiffage, Orano and Air Liquide.

The trusted third party must understand the advantages and disadvantages of each type of structure to create a bespoke programme that responds effectively to the large group’s strategic innovation challenges. But above all, it must be a bridge between the large group and the start-up: indeed, these actors each have differing strategic objectives, which only converge when it comes to innovation. Accuracy can be the trusted third party, acting to orchestrate, coordinate and optimise cooperation in this “shared space”.

1 Relationship between the number of existing support structures in the region and the entirety of existing structures in France.

2 Relationship between the number of opening support structure projects and the already existing support structures (within the region).

3 Share of INSEE income by branch over total 2016 income in France.

4 Number of support structures by specialisation over the total number of support structures.

Sources :

– Accuracy database – December 2019

– David with Goliath study, The alliance of young and large businesses – 2018